You are here

Virus Info

Crickets from Chirp Systems in Smart Lock Key Leak

The U.S. government is warning that “smart locks” securing entry to an estimated 50,000 dwellings nationwide contain hard-coded credentials that can be used to remotely open any of the locks. The lock’s maker Chirp Systems remains unresponsive, even though it was first notified about the critical weakness in March 2021. Meanwhile, Chirp’s parent company, RealPage, Inc., is being sued by multiple U.S. states for allegedly colluding with landlords to illegally raise rents.

On March 7, 2024, the U.S. Cybersecurity & Infrastructure Security Agency (CISA) warned about a remotely exploitable vulnerability with “low attack complexity” in Chirp Systems smart locks.

“Chirp Access improperly stores credentials within its source code, potentially exposing sensitive information to unauthorized access,” CISA’s alert warned, assigning the bug a CVSS (badness) rating of 9.1 (out of a possible 10). “Chirp Systems has not responded to requests to work with CISA to mitigate this vulnerability.”

Matt Brown, the researcher CISA credits with reporting the flaw, is a senior systems development engineer at Amazon Web Services. Brown said he discovered the weakness and reported it to Chirp in March 2021, after the company that manages his apartment building started using Chirp smart locks and told everyone to install Chirp’s app to get in and out of their apartments.

“I use Android, which has a pretty simple workflow for downloading and decompiling the APK apps,” Brown told KrebsOnSecurity. “Given that I am pretty picky about what I trust on my devices, I downloaded Chirp and after decompiling, found that they were storing passwords and private key strings in a file.”

Using those hard-coded credentials, Brown found an attacker could then connect to an application programming interface (API) that Chirp uses which is managed by smart lock vendor August.com, and use that enumerate and remotely lock or unlock any door in any building that uses the technology.

Brown said when he complained to his leasing office, they sold him a small $50 key fob that uses Near-Field Communications (NFC) to toggle the lock when he brings the fob close to his front door. But he said the fob doesn’t eliminate the ability for anyone to remotely unlock his front door using the exposed credentials and the Chirp mobile app.

A smart lock enabled with Chirp. Image: Camdenliving.com

Also, the fobs pass the credentials to his front door over the air in plain text, meaning someone could clone the fob just by bumping against him with a smartphone app made to read and write NFC tags.

Neither August nor Chirp Systems responded to requests for comment. It’s unclear exactly how many apartments and other residences are using the vulnerable Chirp locks, but multiple articles about the company from 2020 state that approximately 50,000 units use Chirp smart locks with August’s API.

Roughly a year before Brown reported the flaw to Chirp Systems, the company was bought by RealPage, a firm founded in 1998 as a developer of multifamily property management and data analytics software. In 2021, RealPage was acquired by the private equity giant Thoma Bravo.

Brown said the exposure he found in Chirp’s products is “an obvious flaw that is super easy to fix.”

“It’s just a matter of them being motivated to do it,” he said. “But they’re part of a private equity company now, so they’re not answerable to anybody. It’s too bad, because it’s not like residents of [the affected] properties have another choice. It’s either agree to use the app or move.”

In October 2022, an investigation by ProPublica examined RealPage’s dominance in the rent-setting software market, and that it found “uses a mysterious algorithm to help landlords push the highest possible rents on tenants.”

“For tenants, the system upends the practice of negotiating with apartment building staff,” ProPublica found. “RealPage discourages bargaining with renters and has even recommended that landlords in some cases accept a lower occupancy rate in order to raise rents and make more money. One of the algorithm’s developers told ProPublica that leasing agents had ‘too much empathy’ compared to computer generated pricing.”

Last year, the U.S. Department of Justice threw its weight behind a massive lawsuit filed by dozens of tenants who are accusing the $9 billion apartment software company of helping landlords collude to inflate rents.

In February 2024, attorneys general for Arizona and the District of Columbia sued RealPage, alleging RealPage’s software helped create a rental monopoly.

Why CISA is Warning CISOs About a Breach at Sisense

The U.S. Cybersecurity and Infrastructure Security Agency (CISA) said today it is investigating a breach at business intelligence company Sisense, whose products are designed to allow companies to view the status of multiple third-party online services in a single dashboard. CISA urged all Sisense customers to reset any credentials and secrets that may have been shared with the company, which is the same advice Sisense gave to its customers Wednesday evening.

New York City based Sisense has more than 1,000 customers across a range of industry verticals, including financial services, telecommunications, healthcare and higher education. On April 10, Sisense Chief Information Security Officer Sangram Dash told customers the company had been made aware of reports that “certain Sisense company information may have been made available on what we have been advised is a restricted access server (not generally available on the internet.)”

“We are taking this matter seriously and promptly commenced an investigation,” Dash continued. “We engaged industry-leading experts to assist us with the investigation. This matter has not resulted in an interruption to our business operations. Out of an abundance of caution, and while we continue to investigate, we urge you to promptly rotate any credentials that you use within your Sisense application.”

In its alert, CISA said it was working with private industry partners to respond to a recent compromise discovered by independent security researchers involving Sisense.

“CISA is taking an active role in collaborating with private industry partners to respond to this incident, especially as it relates to impacted critical infrastructure sector organizations,” the sparse alert reads. “We will provide updates as more information becomes available.”

Sisense declined to comment when asked about the veracity of information shared by two trusted sources with close knowledge of the breach investigation. Those sources said the breach appears to have started when the attackers somehow gained access to the company’s code repository at Gitlab, and that in that repository was a token or credential that gave the bad guys access to Sisense’s Amazon S3 buckets in the cloud.

Both sources said the attackers used the S3 access to copy and exfiltrate several terabytes worth of Sisent customer data, which apparently included millions of access tokens, email account passwords, and even SSL certificates.

The incident raises questions about whether Sisense was doing enough to protect sensitive data entrusted to it by customers, such as whether the massive volume of stolen customer data was ever encrypted while at rest in these Amazon cloud servers.

It is clear, however, that unknown attackers now have all of the credentials that Sisense customers used in their dashboards.

The breach also makes clear that Sisense is somewhat limited in the clean-up actions that it can take on behalf of customers, because access tokens are essentially text files on your computer that allow you to stay logged in for extended periods of time — sometimes indefinitely. And depending on which service we’re talking about, it may be possible for attackers to re-use those access tokens to authenticate as the victim without ever having to present valid credentials.

Beyond that, it is largely up to Sisense customers to decide if and when they change passwords to the various third-party services that they’ve previously entrusted to Sisense.

Earlier today, a public relations firm working with Sisense reached out to learn if KrebsOnSecurity planned to publish any further updates on their breach (KrebsOnSecurity posted a screenshot of the CISO’s customer email to both LinkedIn and Mastodon on Wednesday evening). The PR rep said Sisense wanted to make sure they had an opportunity to comment before the story ran.

But when confronted with the details shared by my sources, Sisense apparently changed its mind.

“After consulting with Sisense, they have told me that they don’t wish to respond,” the PR rep said in an emailed reply.

Nicholas Weaver, a researcher at University of California, Berkeley’s International Computer Science Institute (ICSI) and lecturer at UC Davis, said a company entrusted with so many sensitive logins should absolutely be encrypting that information.

“If they are hosting customer data on a third-party system like Amazon, it better damn well be encrypted,” Weaver said. “If they are telling people to rest credentials, that means it was not encrypted. So mistake number one is leaving Amazon credentials in your Git archive. Mistake number two is using S3 without using encryption on top of it. The former is bad but forgivable, but the latter given their business is unforgivable.”

Twitter’s Clumsy Pivot to X.com Is a Gift to Phishers

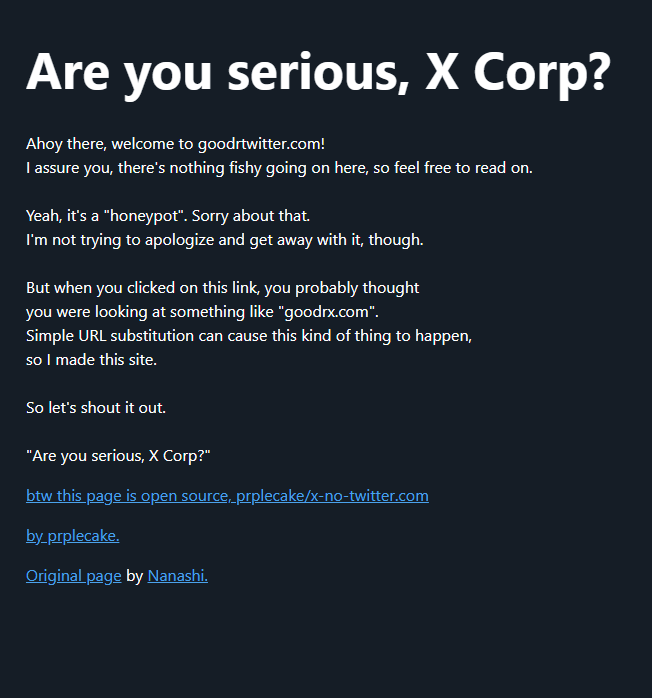

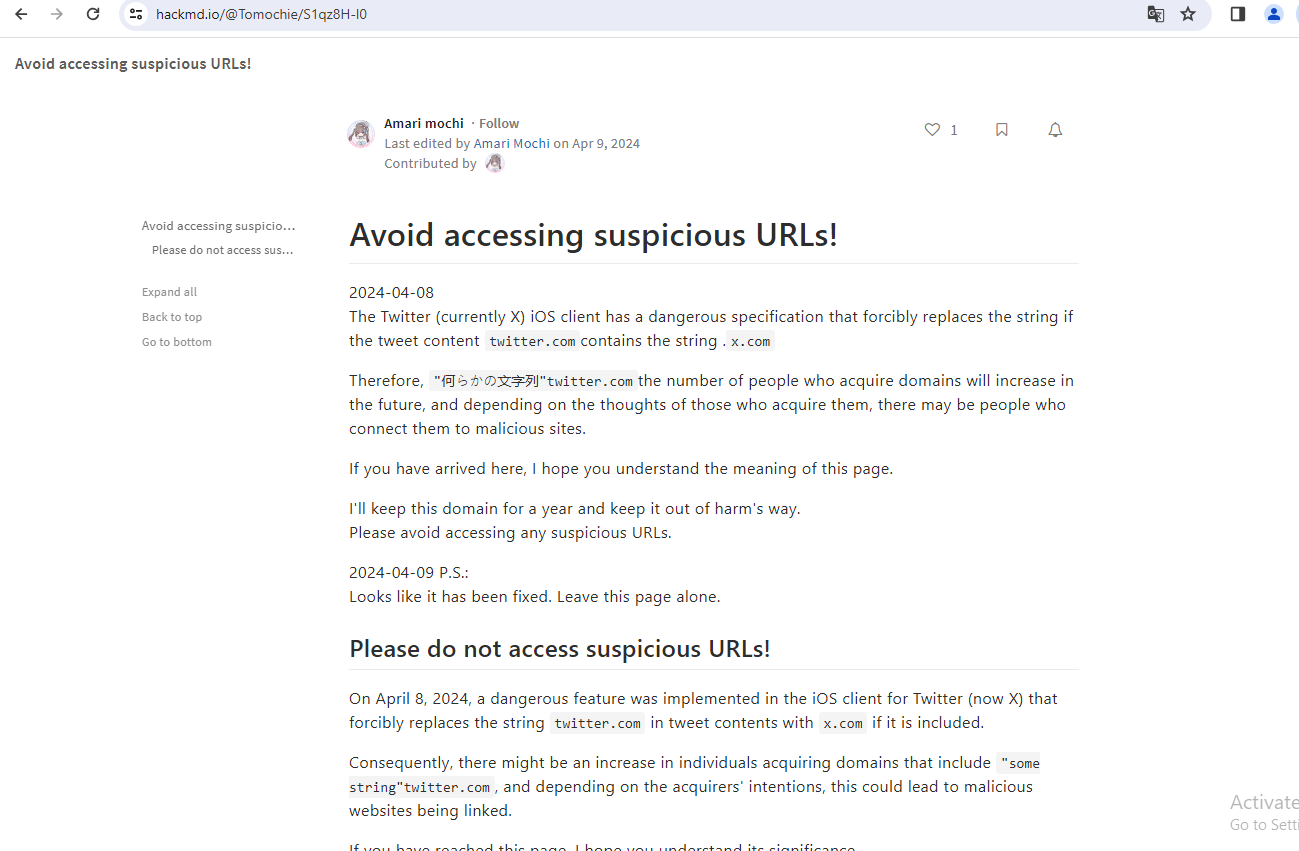

On April 9, Twitter/X began automatically modifying links that mention “twitter.com” to read “x.com” instead. But over the past 48 hours, dozens of new domain names have been registered that demonstrate how this change could be used to craft convincing phishing links — such as fedetwitter[.]com, which until very recently rendered as fedex.com in tweets.

The message displayed when one visits carfatwitter.com, which Twitter/X displayed as carfax.com in tweets and messages.

A search at DomainTools.com shows at least 60 domain names have been registered over the past two days for domains ending in “twitter.com,” although research so far shows the majority of these domains have been registered “defensively” by private individuals to prevent the domains from being purchased by scammers.

Those include carfatwitter.com, which Twitter/X truncated to carfax.com when the domain appeared in user messages or tweets. Visiting this domain currently displays a message that begins, “Are you serious, X Corp?”

Update: It appears Twitter/X has corrected its mistake, and no longer truncates any domain ending in “twitter.com” to “x.com.”

Original story:

The same message is on other newly registered domains, including goodrtwitter.com (goodrx.com), neobutwitter.com (neobux.com), roblotwitter.com (roblox.com), square-enitwitter.com (square-enix.com) and yandetwitter.com (yandex.com). The message left on these domains indicates they were defensively registered by a user on Mastodon whose bio says they are a systems admin/engineer. That profile has not responded to requests for comment.

A number of these new domains including “twitter.com” appear to be registered defensively by Twitter/X users in Japan. The domain netflitwitter.com (netflix.com, to Twitter/X users) now displays a message saying it was “acquired to prevent its use for malicious purposes,” along with a Twitter/X username.

The domain mentioned at the beginning of this story — fedetwitter.com — redirects users to the blog of a Japanese technology enthusiast. A user with the handle “amplest0e” appears to have registered space-twitter.com, which Twitter/X users would see as the CEO’s “space-x.com.” The domain “ametwitter.com” already redirects to the real americanexpress.com.

Some of the domains registered recently and ending in “twitter.com” currently do not resolve and contain no useful contact information in their registration records. Those include firefotwitter[.]com (firefox.com), ngintwitter[.]com (nginx.com), and webetwitter[.]com (webex.com).

The domain setwitter.com, which Twitter/X until very recently rendered as “sex.com,” redirects to this blog post warning about the recent changes and their potential use for phishing.

Sean McNee, vice president of research and data at DomainTools, told KrebsOnSecurity it appears Twitter/X did not properly limit its redirection efforts.

“Bad actors could register domains as a way to divert traffic from legitimate sites or brands given the opportunity — many such brands in the top million domains end in x, such as webex, hbomax, xerox, xbox, and more,” McNee said. “It is also notable that several other globally popular brands, such as Rolex and Linux, were also on the list of registered domains.”

The apparent oversight by Twitter/X was cause for amusement and amazement from many former users who have migrated to other social media platforms since the new CEO took over. Matthew Garrett, a lecturer at U.C. Berkeley’s School of Information, summed up the Schadenfreude thusly:

“Twitter just doing a ‘redirect links in tweets that go to x.com to twitter.com instead but accidentally do so for all domains that end x.com like eg spacex.com going to spacetwitter.com’ is not absolutely the funniest thing I could imagine but it’s high up there.”

April’s Patch Tuesday Brings Record Number of Fixes

If only Patch Tuesdays came around infrequently — like total solar eclipse rare — instead of just creeping up on us each month like The Man in the Moon. Although to be fair, it would be tough for Microsoft to eclipse the number of vulnerabilities fixed in this month’s patch batch — a record 147 flaws in Windows and related software.

Yes, you read that right. Microsoft today released updates to address 147 security holes in Windows, Office, Azure, .NET Framework, Visual Studio, SQL Server, DNS Server, Windows Defender, Bitlocker, and Windows Secure Boot.

“This is the largest release from Microsoft this year and the largest since at least 2017,” said Dustin Childs, from Trend Micro’s Zero Day Initiative (ZDI). “As far as I can tell, it’s the largest Patch Tuesday release from Microsoft of all time.”

Once again this month, there are no known zero-day vulnerabilities threatening Windows users. Tempering the sheer volume of this month’s patches is the middling severity of many of the bugs. Only three of April’s vulnerabilities earned Microsoft’s most-dire “critical” rating, meaning they can be abused by malware or malcontents to take remote control over unpatched systems with no help from users.

Most of the flaws that Microsoft deems “more likely to be exploited” this month are marked as “important,” which usually involve bugs that require a bit more user interaction (social engineering) but which nevertheless can result in system security bypass, compromise, and the theft of critical assets.

Ben McCarthy, lead cyber security engineer at Immersive Labs called attention to CVE-2024-20670, an Outlook for Windows spoofing vulnerability described as being easy to exploit. It involves convincing a user to click on a malicious link in an email, which can then steal the user’s password hash and authenticate as the user in another Microsoft service.

Another interesting bug McCarthy pointed to is CVE-2024-29063, which involves hard-coded credentials in Azure’s search backend infrastructure that could be gleaned by taking advantage of Azure AI search.

“This along with many other AI attacks in recent news shows a potential new attack surface that we are just learning how to mitigate against,” McCarthy said. “Microsoft has updated their backend and notified any customers who have been affected by the credential leakage.”

CVE-2024-29988 is a weakness that allows attackers to bypass Windows SmartScreen, a technology Microsoft designed to provide additional protections for end users against phishing and malware attacks. Childs said one ZDI’s researchers found this vulnerability being exploited in the wild, although Microsoft doesn’t currently list CVE-2024-29988 as being exploited.

“I would treat this as in the wild until Microsoft clarifies,” Childs said. “The bug itself acts much like CVE-2024-21412 – a [zero-day threat from February] that bypassed the Mark of the Web feature and allows malware to execute on a target system. Threat actors are sending exploits in a zipped file to evade EDR/NDR detection and then using this bug (and others) to bypass Mark of the Web.”

Satnam Narang at Tenable notes that this month’s release includes fixes for two dozen flaws in Windows Secure Boot, the majority of which are considered “Exploitation Less Likely” according to Microsoft.

“However, the last time Microsoft patched a flaw in Windows Secure Boot in May 2023 had a notable impact as it was exploited in the wild and linked to the BlackLotus UEFI bootkit, which was sold on dark web forums for $5,000,” Narang said. “BlackLotus can bypass functionality called secure boot, which is designed to block malware from being able to load when booting up. While none of these Secure Boot vulnerabilities addressed this month were exploited in the wild, they serve as a reminder that flaws in Secure Boot persist, and we could see more malicious activity related to Secure Boot in the future.”

For links to individual security advisories indexed by severity, check out ZDI’s blog and the Patch Tuesday post from the SANS Internet Storm Center. Please consider backing up your data or your drive before updating, and drop a note in the comments here if you experience any issues applying these fixes.

Adobe today released nine patches tackling at least two dozen vulnerabilities in a range of software products, including Adobe After Effects, Photoshop, Commerce, InDesign, Experience Manager, Media Encoder, Bridge, Illustrator, and Adobe Animate.

KrebsOnSecurity needs to correct the record on a point mentioned at the end of March’s “Fat Patch Tuesday” post, which looked at new AI capabilities built into Adobe Acrobat that are turned on by default. Adobe has since clarified that its apps won’t use AI to auto-scan your documents, as the original language in its FAQ suggested.

“In practice, no document scanning or analysis occurs unless a user actively engages with the AI features by agreeing to the terms, opening a document, and selecting the AI Assistant or generative summary buttons for that specific document,” Adobe said earlier this month.

Fake Lawsuit Threat Exposes Privnote Phishing Sites

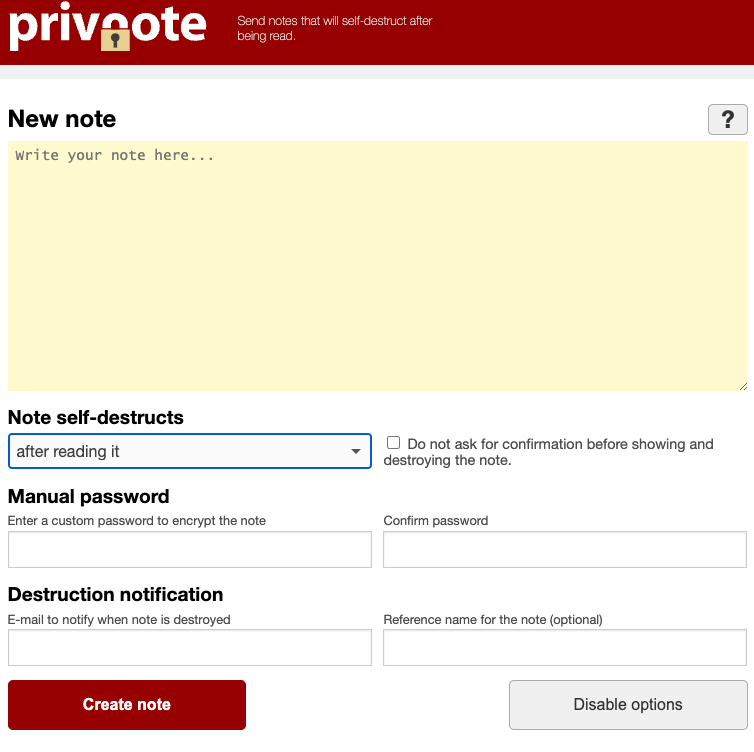

A cybercrook who has been setting up websites that mimic the self-destructing message service privnote.com accidentally exposed the breadth of their operations recently when they threatened to sue a software company. The disclosure revealed a profitable network of phishing sites that behave and look like the real Privnote, except that any messages containing cryptocurrency addresses will be automatically altered to include a different payment address controlled by the scammers.

The real Privnote, at privnote.com.

Launched in 2008, privnote.com employs technology that encrypts each message so that even Privnote itself cannot read its contents. And it doesn’t send or receive messages. Creating a message merely generates a link. When that link is clicked or visited, the service warns that the message will be gone forever after it is read.

Privnote’s ease-of-use and popularity among cryptocurrency enthusiasts has made it a perennial target of phishers, who erect Privnote clones that function more or less as advertised but also quietly inject their own cryptocurrency payment addresses when a note is created that contains crypto wallets.

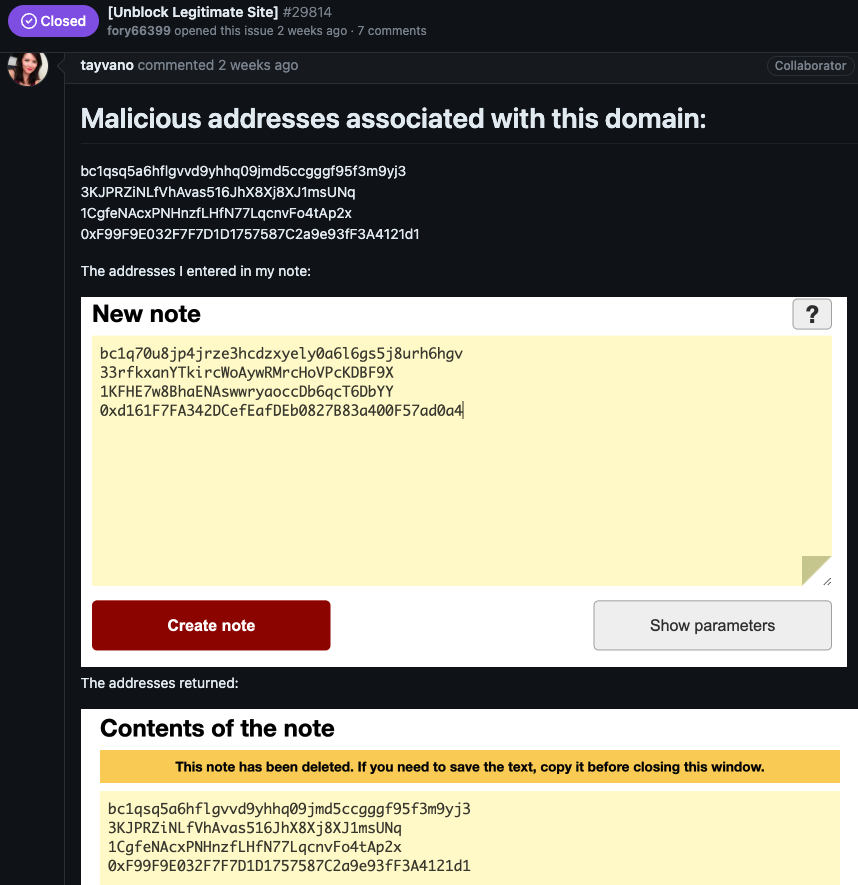

Last month, a new user on GitHub named fory66399 lodged a complaint on the “issues” page for MetaMask, a software cryptocurrency wallet used to interact with the Ethereum blockchain. Fory66399 insisted that their website — privnote[.]co — was being wrongly flagged by MetaMask’s “eth-phishing-detect” list as malicious.

“We filed a lawsuit with a lawyer for dishonestly adding a site to the block list, damaging reputation, as well as ignoring the moderation department and ignoring answers!” fory66399 threatened. “Provide evidence or I will demand compensation!”

MetaMask’s lead product manager Taylor Monahan replied by posting several screenshots of privnote[.]co showing the site did indeed swap out any cryptocurrency addresses.

After being told where they could send a copy of their lawsuit, Fory66399 appeared to become flustered, and proceeded to mention a number of other interesting domain names:

You sent me screenshots from some other site! It’s red!!!!

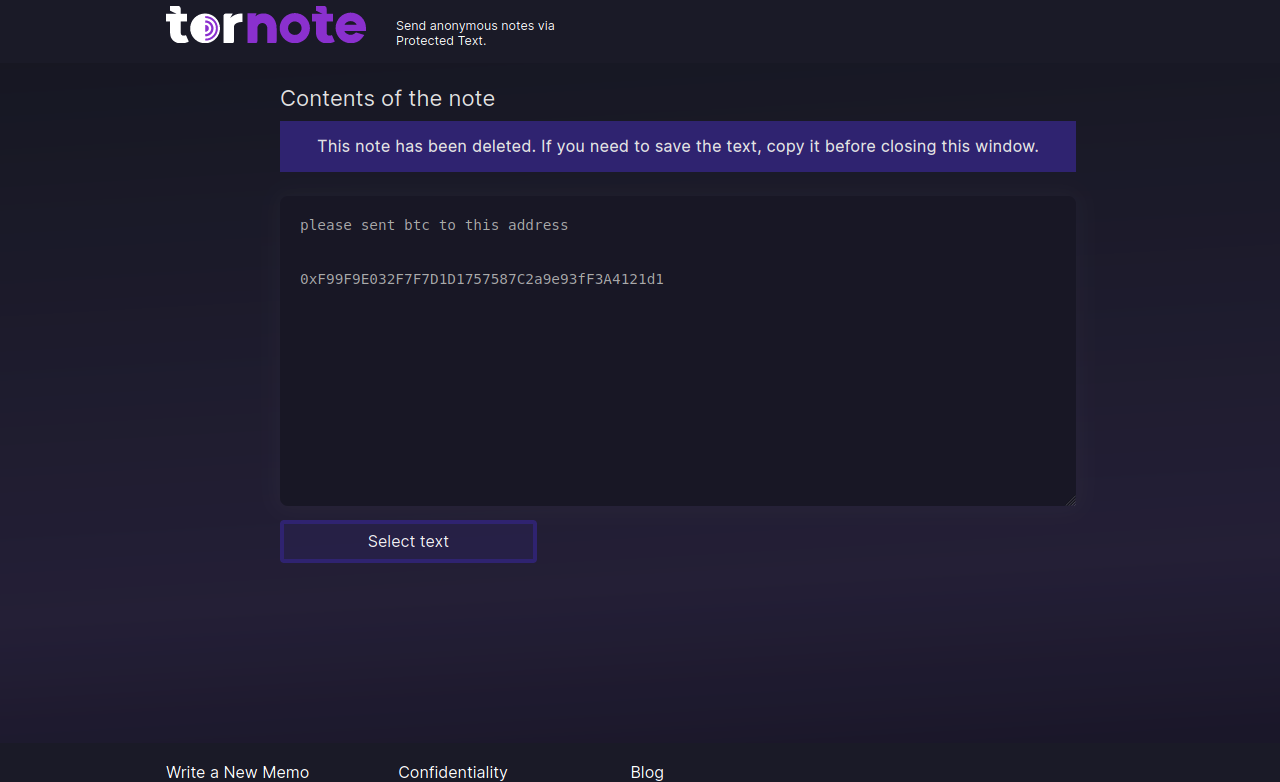

The tornote.io website has a different color altogether

The privatenote,io website also has a different color! What’s wrong?????

A search at DomainTools.com for privatenote[.]io shows it has been registered to two names over as many years, including Andrey Sokol from Moscow and Alexandr Ermakov from Kiev. There is no indication these are the real names of the phishers, but the names are useful in pointing to other sites targeting Privnote since 2020.

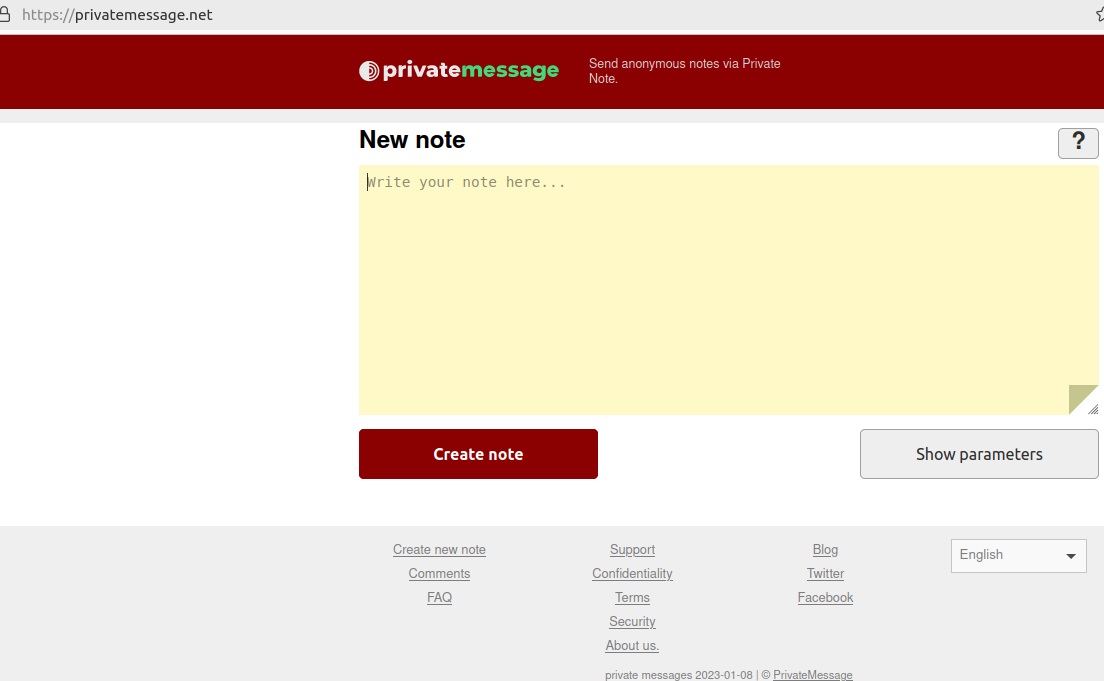

DomainTools says other domains registered to Alexandr Ermakov include pirvnota[.]com, privatemessage[.]net, privatenote[.]io, and tornote[.]io.

A screenshot of the phishing domain privatemessage dot net.

The registration records for pirvnota[.]com at one point were updated from Andrey Sokol to “BPW” as the registrant organization, and “Tambov district” in the registrant state/province field. Searching DomainTools for domains that include both of these terms reveals pirwnote[.]com.

Other Privnote phishing domains that also phoned home to the same Internet address as pirwnote[.]com include privnode[.]com, privnate[.]com, and prevnóte[.]com. Pirwnote[.]com is currently selling security cameras made by the Chinese manufacturer Hikvision, via an Internet address based in Hong Kong.

It appears someone has gone to great lengths to make tornote[.]io seem like a legitimate website. For example, this account at Medium has authored more than a dozen blog posts in the past year singing the praises of Tornote as a secure, self-destructing messaging service. However, testing shows tornote[.]io will also replace any cryptocurrency addresses in messages with their own payment address.

These malicious note sites attract visitors by gaming search engine results to make the phishing domains appear prominently in search results for “privnote.” A search in Google for “privnote” currently returns tornote[.]io as the fifth result. Like other phishing sites tied to this network, Tornote will use the same cryptocurrency addresses for roughly 5 days, and then rotate in new payment addresses.

Tornote changed the cryptocurrency address entered into a test note to this address controlled by the phishers.

Throughout 2023, Tornote was hosted with the Russian provider DDoS-Guard, at the Internet address 186.2.163[.]216. A review of the passive DNS records tied to this address shows that apart from subdomains dedicated to tornote[.]io, the main other domain at this address was hkleaks[.]ml.

In August 2019, a slew of websites and social media channels dubbed “HKLEAKS” began doxing the identities and personal information of pro-democracy activists in Hong Kong. According to a report (PDF) from Citizen Lab, hkleaks[.]ml was the second domain that appeared as the perpetrators began to expand the list of those doxed.

HKleaks, as indexed by The Wayback Machine.

The address 186.2.163[.]216 also is home to the website rustraitor[.]info, a website erected after Russia invaded Ukraine in early 2022 that doxed Russians perceived to have helped the Ukrainian cause.

An archive.org copy of Rustraitor.

DomainTools shows there are more than 1,000 other domains whose registration records include the organization name “BPW” and “Tambov District” as the location. Virtually all of those domains were registered through one of two registrars — Hong Kong-based Nicenic and Singapore-based WebCC — and almost all appear to be phishing or pill-spam related.

In keeping with the overall theme, these phishing domains appear focused on stealing usernames and passwords to some of the cybercrime underground’s busiest shops, including Brian’s Club. What do all the phished sites have in common? They all accept payment via virtual currencies.

It appears MetaMask’s Monahan made the correct decision in forcing these phishers to tip their hand: Among the websites at that DDoS-Guard address are multiple MetaMask phishing domains, including metarrnask[.]com, meternask[.]com, and rnetamask[.]com.

How profitable are these private note phishing sites? Reviewing the four malicious cryptocurrency payment addresses that the attackers swapped into notes passed through privnote[.]co (as pictured in Monahan’s screenshot above) shows that between March 15 and March 19, 2024, those address raked in and transferred out nearly $18,000 in cryptocurrencies. And that’s just one of their phishing websites.

‘The Manipulaters’ Improve Phishing, Still Fail at Opsec

Roughly nine years ago, KrebsOnSecurity profiled a Pakistan-based cybercrime group called “The Manipulaters,” a sprawling web hosting network of phishing and spam delivery platforms. In January 2024, The Manipulaters pleaded with this author to unpublish previous stories about their work, claiming the group had turned over a new leaf and gone legitimate. But new research suggests that while they have improved the quality of their products and services, these nitwits still fail spectacularly at hiding their illegal activities.

In May 2015, KrebsOnSecurity published a brief writeup about the brazen Manipulaters team, noting that they openly operated hundreds of web sites selling tools designed to trick people into giving up usernames and passwords, or deploying malicious software on their PCs.

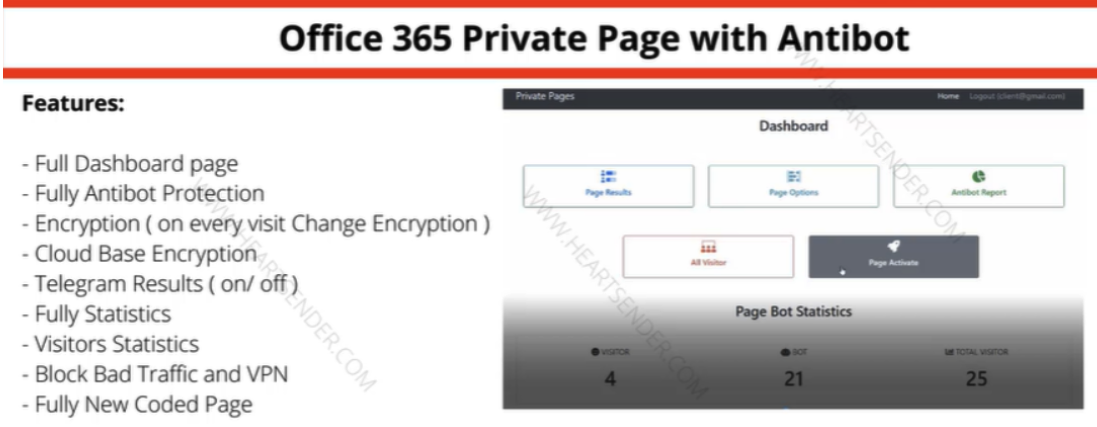

Manipulaters advertisement for “Office 365 Private Page with Antibot” phishing kit sold on the domain heartsender,com. “Antibot” refers to functionality that attempts to evade automated detection techniques, keeping a phish deployed as long as possible. Image: DomainTools.

The core brand of The Manipulaters has long been a shared cybercriminal identity named “Saim Raza,” who for the past decade has peddled a popular spamming and phishing service variously called “Fudtools,” “Fudpage,” “Fudsender,” “FudCo,” etc. The term “FUD” in those names stands for “Fully Un-Detectable,” and it refers to cybercrime resources that will evade detection by security tools like antivirus software or anti-spam appliances.

A September 2021 story here checked in on The Manipulaters, and found that Saim Raza and company were prospering under their FudCo brands, which they secretly managed from a front company called We Code Solutions.

That piece worked backwards from all of the known Saim Raza email addresses to identify Facebook profiles for multiple We Code Solutions employees, many of whom could be seen celebrating company anniversaries gathered around a giant cake with the words “FudCo” painted in icing.

Since that story ran, KrebsOnSecurity has heard from this Saim Raza identity on two occasions. The first was in the weeks following the Sept. 2021 piece, when one of Saim Raza’s known email addresses — bluebtcus@gmail.com — pleaded to have the story taken down.

“Hello, we already leave that fud etc before year,” the Saim Raza identity wrote. “Why you post us? Why you destroy our lifes? We never harm anyone. Please remove it.”

Not wishing to be manipulated by a phishing gang, KrebsOnSecurity ignored those entreaties. But on Jan. 14, 2024, KrebsOnSecurity heard from the same bluebtcus@gmail.com address, apropos of nothing.

“Please remove this article,” Sam Raza wrote, linking to the 2021 profile. “Please already my police register case on me. I already leave everything.”

Asked to elaborate on the police investigation, Saim Raza said he was freshly released from jail.

“I was there many days,” the reply explained. “Now back after bail. Now I want to start my new work.”

Exactly what that “new work” might entail, Saim Raza wouldn’t say. But a new report from researchers at DomainTools.com finds that several computers associated with The Manipulaters have been massively hacked by malicious data- and password-snarfing malware for quite some time.

DomainTools says the malware infections on Manipulaters PCs exposed “vast swaths of account-related data along with an outline of the group’s membership, operations, and position in the broader underground economy.”

“Curiously, the large subset of identified Manipulaters customers appear to be compromised by the same stealer malware,” DomainTools wrote. “All observed customer malware infections began after the initial compromise of Manipulaters PCs, which raises a number of questions regarding the origin of those infections.”

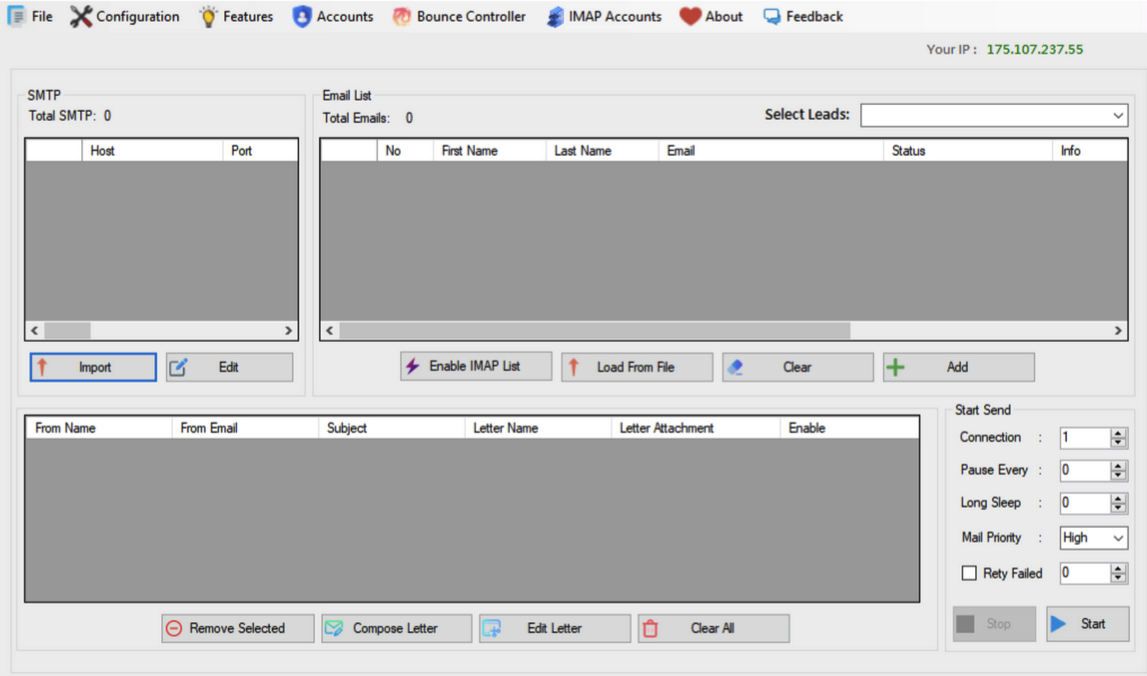

A number of questions, indeed. The core Manipulaters product these days is a spam delivery service called HeartSender, whose homepage openly advertises phishing kits targeting users of various Internet companies, including Microsoft 365, Yahoo, AOL, Intuit, iCloud and ID.me, to name a few.

A screenshot of the homepage of HeartSender 4 displays an IP address tied to fudtoolshop@gmail.com. Image: DomainTools.

HeartSender customers can interact with the subscription service via the website, but the product appears to be far more effective and user-friendly if one downloads HeartSender as a Windows executable program. Whether that HeartSender program was somehow compromised and used to infect the service’s customers is unknown.

However, DomainTools also found the hosted version of HeartSender service leaks an extraordinary amount of user information that probably is not intended to be publicly accessible. Apparently, the HeartSender web interface has several webpages that are accessible to unauthenticated users, exposing customer credentials along with support requests to HeartSender developers.

“Ironically, the Manipulaters may create more short-term risk to their own customers than law enforcement,” DomainTools wrote. “The data table “User Feedbacks” (sic) exposes what appear to be customer authentication tokens, user identifiers, and even a customer support request that exposes root-level SMTP credentials–all visible by an unauthenticated user on a Manipulaters-controlled domain. Given the risk for abuse, this domain will not be published.”

This is hardly the first time The Manipulaters have shot themselves in the foot. In 2019, The Manipulaters failed to renew their core domain name — manipulaters[.]com — the same one tied to so many of the company’s past and current business operations. That domain was quickly scooped up by Scylla Intel, a cyber intelligence firm that focuses on connecting cybercriminals to their real-life identities.

Currently, The Manipulaters seem focused on building out and supporting HeartSender, which specializes in spam and email-to-SMS spamming services.

“The Manipulaters’ newfound interest in email-to-SMS spam could be in response to the massive increase in smishing activity impersonating the USPS,” DomainTools wrote. “Proofs posted on HeartSender’s Telegram channel contain numerous references to postal service impersonation, including proving delivery of USPS-themed phishing lures and the sale of a USPS phishing kit.”

Reached via email, the Saim Raza identity declined to respond to questions about the DomainTools findings.

“First [of] all we never work on virus or compromised computer etc,” Raza replied. “If you want to write like that fake go ahead. Second I leave country already. If someone bind anything with exe file and spread on internet its not my fault.”

Asked why they left Pakistan, Saim Raza said the authorities there just wanted to shake them down.

“After your article our police put FIR on my [identity],” Saim Raza explained. “FIR” in this case stands for “First Information Report,” which is the initial complaint in the criminal justice system of Pakistan.

“They only get money from me nothing else,” Saim Raza continued. “Now some officers ask for money again again. Brother, there is no good law in Pakistan just they need money.”

Saim Raza has a history of being slippery with the truth, so who knows whether The Manipulaters and/or its leaders have in fact fled Pakistan (it may be more of an extended vacation abroad). With any luck, these guys will soon venture into a more Western-friendly, “good law” nation and receive a warm welcome by the local authorities.

Thread Hijacking: Phishes That Prey on Your Curiosity

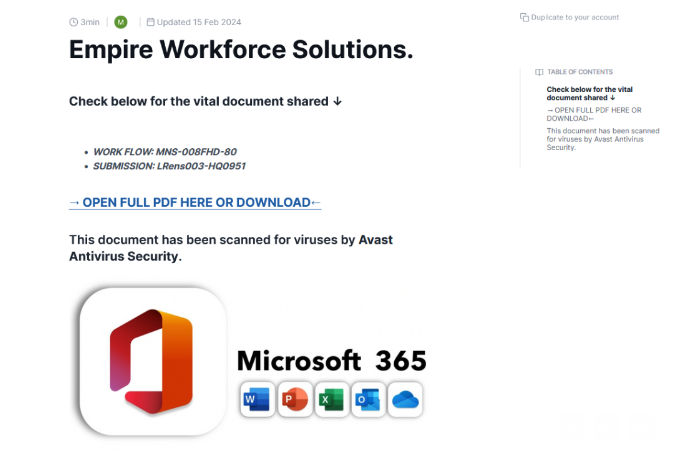

Thread hijacking attacks. They happen when someone you know has their email account compromised, and you are suddenly dropped into an existing conversation between the sender and someone else. These missives draw on the recipient’s natural curiosity about being copied on a private discussion, which is modified to include a malicious link or attachment. Here’s the story of a recent thread hijacking attack in which a journalist was copied on a phishing email from the unwilling subject of a recent scoop.

In Sept. 2023, the Pennsylvania news outlet LancasterOnline.com published a story about Adam Kidan, a wealthy businessman with a criminal past who is a major donor to Republican causes and candidates, including Rep. Lloyd Smucker (R-Pa).

The LancasterOnline story about Adam Kidan.

Several months after that piece ran, the story’s author Brett Sholtis received two emails from Kidan, both of which contained attachments. One of the messages appeared to be a lengthy conversation between Kidan and a colleague, with the subject line, “Re: Successfully sent data.” The second missive was a more brief email from Kidan with the subject, “Acknowledge New Work Order,” and a message that read simply, “Please find the attached.”

Sholtis said he clicked the attachment in one of the messages, which then launched a web page that looked exactly like a Microsoft Office 365 login page. An analysis of the webpage reveals it would check any submitted credentials at the real Microsoft website, and return an error if the user entered bogus account information. A successful login would record the submitted credentials and forward the victim to the real Microsoft website.

But Sholtis said he didn’t enter his Outlook username and password. Instead, he forwarded the messages to LancasterOneline’s IT team, which quickly flagged them as phishing attempts.

LancasterOnline’s Executive Editor Tom Murse said the two phishing messages from Mr. Kidan raised eyebrows in the newsroom because Kidan had threatened to sue the news outlet multiple times over Sholtis’s story.

“We were just perplexed,” Murse said. “It seemed to be a phishing attempt but we were confused why it would come from a prominent businessman we’ve written about. Our initial response was confusion, but we didn’t know what else to do with it other than to send it to the FBI.”

The phishing lure attached to the thread hijacking email from Mr. Kidan.

In 2006, Kidan was sentenced to 70 months in federal prison after pleading guilty to defrauding lenders along with Jack Abramoff, the disgraced lobbyist whose corruption became a symbol of the excesses of Washington influence peddling. He was paroled in 2009, and in 2014 moved his family to a home in Lancaster County, Pa.

The FBI hasn’t responded to LancasterOnline’s tip. Messages sent by KrebsOnSecurity to Kidan’s emails addresses were returned as blocked. Messages left with Mr. Kidan’s company, Empire Workforce Solutions, went unreturned.

No doubt the FBI saw the messages from Kidan for what they likely were: The result of Mr. Kidan having his Microsoft Outlook account compromised and used to send malicious email to people in his contacts list.

Thread hijacking attacks are hardly new, but that is mainly true because many Internet users still don’t know how to identify them. The email security firm Proofpoint says it has tracked north of 90 million malicious messages in the last five years that leverage this attack method.

One key reason thread hijacking is so successful is that these attacks generally do not include the tell that exposes most phishing scams: A fabricated sense of urgency. A majority of phishing threats warn of negative consequences should you fail to act quickly — such as an account suspension or an unauthorized high-dollar charge going through.

In contrast, thread hijacking campaigns tend to patiently prey on the natural curiosity of the recipient.

Ryan Kalember, chief strategy officer at Proofpoint, said probably the most ubiquitous examples of thread hijacking are “CEO fraud” or “business email compromise” scams, wherein employees are tricked by an email from a senior executive into wiring millions of dollars to fraudsters overseas.

But Kalember said these low-tech attacks can nevertheless be quite effective because they tend to catch people off-guard.

“It works because you feel like you’re suddenly included in an important conversation,” Kalember said. “It just registers a lot differently when people start reading, because you think you’re observing a private conversation between two different people.”

Some thread hijacking attacks actually involve multiple threat actors who are actively conversing while copying — but not addressing — the recipient.

“We call these mutli-persona phishing scams, and they’re often paired with thread hijacking,” Kalember said. “It’s basically a way to build a little more affinity than just copying people on an email. And the longer the conversation goes on, the higher their success rate seems to be because some people start replying to the thread [and participating] psycho-socially.”

The best advice to sidestep phishing scams is to avoid clicking on links or attachments that arrive unbidden in emails, text messages and other mediums. If you’re unsure whether the message is legitimate, take a deep breath and visit the site or service in question manually — ideally, using a browser bookmark so as to avoid potential typosquatting sites.

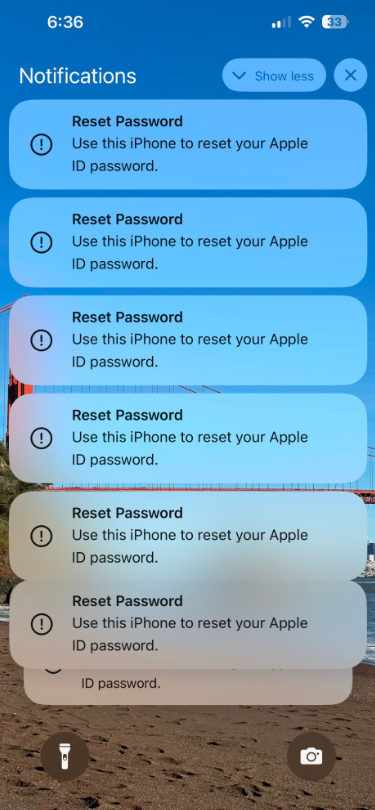

Recent ‘MFA Bombing’ Attacks Targeting Apple Users

Several Apple customers recently reported being targeted in elaborate phishing attacks that involve what appears to be a bug in Apple’s password reset feature. In this scenario, a target’s Apple devices are forced to display dozens of system-level prompts that prevent the devices from being used until the recipient responds “Allow” or “Don’t Allow” to each prompt. Assuming the user manages not to fat-finger the wrong button on the umpteenth password reset request, the scammers will then call the victim while spoofing Apple support in the caller ID, saying the user’s account is under attack and that Apple support needs to “verify” a one-time code.

Some of the many notifications Patel says he received from Apple all at once.

Parth Patel is an entrepreneur who is trying to build a startup in the cryptocurrency space. On March 23, Patel documented on Twitter/X a recent phishing campaign targeting him that involved what’s known as a “push bombing” or “MFA fatigue” attack, wherein the phishers abuse a feature or weakness of a multi-factor authentication (MFA) system in a way that inundates the target’s device(s) with alerts to approve a password change or login.

“All of my devices started blowing up, my watch, laptop and phone,” Patel told KrebsOnSecurity. “It was like this system notification from Apple to approve [a reset of the account password], but I couldn’t do anything else with my phone. I had to go through and decline like 100-plus notifications.”

Some people confronted with such a deluge may eventually click “Allow” to the incessant password reset prompts — just so they can use their phone again. Others may inadvertently approve one of these prompts, which will also appear on a user’s Apple watch if they have one.

But the attackers in this campaign had an ace up their sleeves: Patel said after denying all of the password reset prompts from Apple, he received a call on his iPhone that said it was from Apple Support (the number displayed was 1-800-275-2273, Apple’s real customer support line).

“I pick up the phone and I’m super suspicious,” Patel recalled. “So I ask them if they can verify some information about me, and after hearing some aggressive typing on his end he gives me all this information about me and it’s totally accurate.”

All of it, that is, except his real name. Patel said when he asked the fake Apple support rep to validate the name they had on file for the Apple account, the caller gave a name that was not his but rather one that Patel has only seen in background reports about him that are for sale at a people-search website called PeopleDataLabs.

Patel said he has worked fairly hard to remove his information from multiple people-search websites, and he found PeopleDataLabs uniquely and consistently listed this inaccurate name as an alias on his consumer profile.

“For some reason, PeopleDataLabs has three profiles that come up when you search for my info, and two of them are mine but one is an elementary school teacher from the midwest,” Patel said. “I asked them to verify my name and they said Anthony.”

Patel said the goal of the voice phishers is to trigger an Apple ID reset code to be sent to the user’s device, which is a text message that includes a one-time password. If the user supplies that one-time code, the attackers can then reset the password on the account and lock the user out. They can also then remotely wipe all of the user’s Apple devices.

THE PHONE NUMBER IS KEYChris is a cryptocurrency hedge fund owner who asked that only his first name be used so as not to paint a bigger target on himself. Chris told KrebsOnSecurity he experienced a remarkably similar phishing attempt in late February.

“The first alert I got I hit ‘Don’t Allow’, but then right after that I got like 30 more notifications in a row,” Chris said. “I figured maybe I sat on my phone weird, or was accidentally pushing some button that was causing these, and so I just denied them all.”

Chris says the attackers persisted hitting his devices with the reset notifications for several days after that, and at one point he received a call on his iPhone that said it was from Apple support.

“I said I would call them back and hung up,” Chris said, demonstrating the proper response to such unbidden solicitations. “When I called back to the real Apple, they couldn’t say whether anyone had been in a support call with me just then. They just said Apple states very clearly that it will never initiate outbound calls to customers — unless the customer requests to be contacted.”

Massively freaking out that someone was trying to hijack his digital life, Chris said he changed his passwords and then went to an Apple store and bought a new iPhone. From there, he created a new Apple iCloud account using a brand new email address.

Chris said he then proceeded to get even more system alerts on his new iPhone and iCloud account — all the while still sitting at the local Apple Genius Bar.

Chris told KrebsOnSecurity his Genius Bar tech was mystified about the source of the alerts, but Chris said he suspects that whatever the phishers are abusing to rapidly generate these Apple system alerts requires knowing the phone number on file for the target’s Apple account. After all, that was the only aspect of Chris’s new iPhone and iCloud account that hadn’t changed.

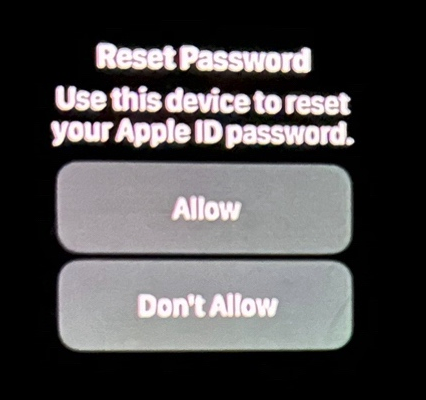

WATCH OUT!“Ken” is a security industry veteran who spoke on condition of anonymity. Ken said he first began receiving these unsolicited system alerts on his Apple devices earlier this year, but that he has not received any phony Apple support calls as others have reported.

“This recently happened to me in the middle of the night at 12:30 a.m.,” Ken said. “And even though I have my Apple watch set to remain quiet during the time I’m usually sleeping at night, it woke me up with one of these alerts. Thank god I didn’t press ‘Allow,’ which was the first option shown on my watch. I had to scroll watch the wheel to see and press the ‘Don’t Allow’ button.”

Ken shared this photo he took of an alert on his watch that woke him up at 12:30 a.m. Ken said he had to scroll on the watch face to see the “Don’t Allow” button.

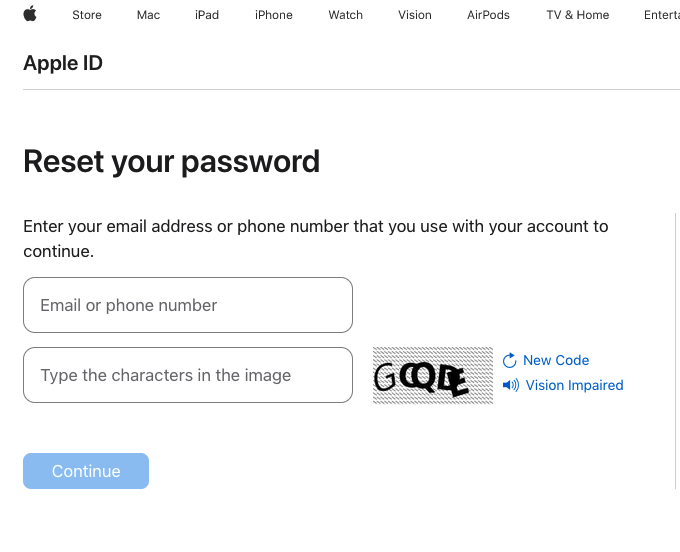

Unnerved by the idea that he could have rolled over on his watch while sleeping and allowed criminals to take over his Apple account, Ken said he contacted the real Apple support and was eventually escalated to a senior Apple engineer. The engineer assured Ken that turning on an Apple Recovery Key for his account would stop the notifications once and for all.

A recovery key is an optional security feature that Apple says “helps improve the security of your Apple ID account.” It is a randomly generated 28-character code, and when you enable a recovery key it is supposed to disable Apple’s standard account recovery process. The thing is, enabling it is not a simple process, and if you ever lose that code in addition to all of your Apple devices you will be permanently locked out.

Ken said he enabled a recovery key for his account as instructed, but that it hasn’t stopped the unbidden system alerts from appearing on all of his devices every few days.

KrebsOnSecurity tested Ken’s experience, and can confirm that enabling a recovery key does nothing to stop a password reset prompt from being sent to associated Apple devices. Visiting Apple’s “forgot password” page — https://iforgot.apple.com — asks for an email address and for the visitor to solve a CAPTCHA.

After that, the page will display the last two digits of the phone number tied to the Apple account. Filling in the missing digits and hitting submit on that form will send a system alert, whether or not the user has enabled an Apple Recovery Key.

The password reset page at iforgot.apple.com.

RATE LIMITSWhat sanely designed authentication system would send dozens of requests for a password change in the span of a few moments, when the first requests haven’t even been acted on by the user? Could this be the result of a bug in Apple’s systems?

Apple has not yet responded to requests for comment.

Throughout 2022, a criminal hacking group known as LAPSUS$ used MFA bombing to great effect in intrusions at Cisco, Microsoft and Uber. In response, Microsoft began enforcing “MFA number matching,” a feature that displays a series of numbers to a user attempting to log in with their credentials. These numbers must then be entered into the account owner’s Microsoft authenticator app on their mobile device to verify they are logging into the account.

Kishan Bagaria is a hobbyist security researcher and engineer who founded the website texts.com (now owned by Automattic), and he’s convinced Apple has a problem on its end. In August 2019, Bagaria reported to Apple a bug that allowed an exploit he dubbed “AirDoS” because it could be used to let an attacker infinitely spam all nearby iOS devices with a system-level prompt to share a file via AirDrop — a file-sharing capability built into Apple products.

Apple fixed that bug nearly four months later in December 2019, thanking Bagaria in the associated security bulletin. Bagaria said Apple’s fix for that bug was to add stricter rate limiting on AirDrop requests, and he suspects that someone has figured out a way to bypass Apple’s rate limit on how many of these password reset requests can be sent in a given timeframe.

“I think this could be a legit Apple rate limit bug that should be reported,” Bagaria said.

Mozilla Drops Onerep After CEO Admits to Running People-Search Networks

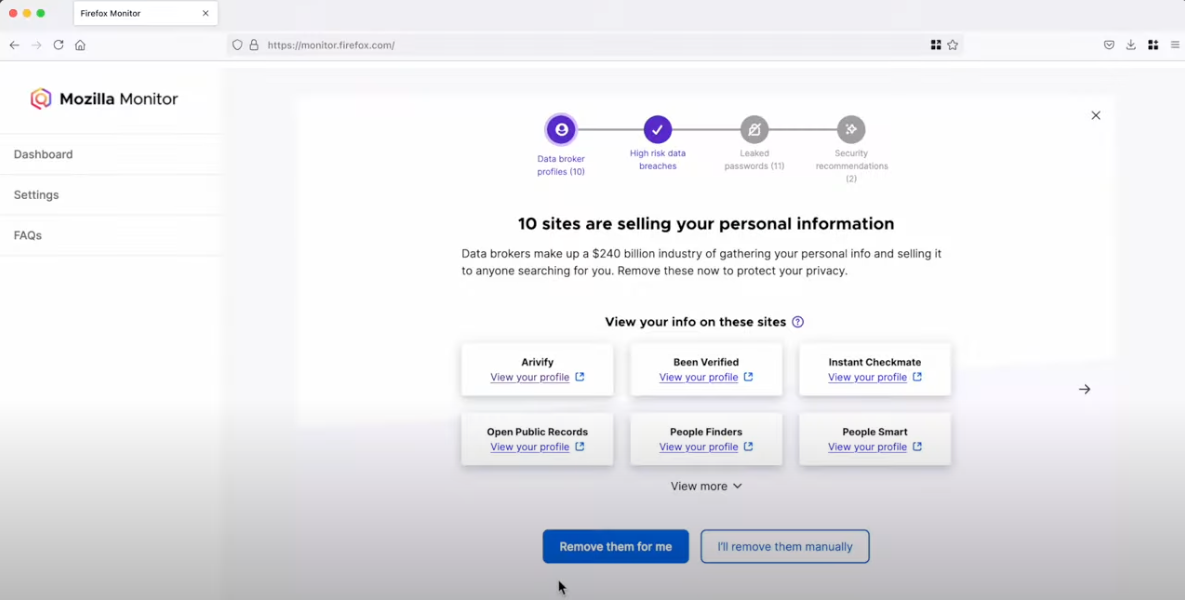

The nonprofit organization that supports the Firefox web browser said today it is winding down its new partnership with Onerep, an identity protection service recently bundled with Firefox that offers to remove users from hundreds of people-search sites. The move comes just days after a report by KrebsOnSecurity forced Onerep’s CEO to admit that he has founded dozens of people-search networks over the years.

Mozilla Monitor. Image Mozilla Monitor Plus video on Youtube.

Mozilla only began bundling Onerep in Firefox last month, when it announced the reputation service would be offered on a subscription basis as part of Mozilla Monitor Plus. Launched in 2018 under the name Firefox Monitor, Mozilla Monitor also checks data from the website Have I Been Pwned? to let users know when their email addresses or password are leaked in data breaches.

On March 14, KrebsOnSecurity published a story showing that Onerep’s Belarusian CEO and founder Dimitiri Shelest launched dozens of people-search services since 2010, including a still-active data broker called Nuwber that sells background reports on people. Onerep and Shelest did not respond to requests for comment on that story.

But on March 21, Shelest released a lengthy statement wherein he admitted to maintaining an ownership stake in Nuwber, a consumer data broker he founded in 2015 — around the same time he launched Onerep.

Shelest maintained that Nuwber has “zero cross-over or information-sharing with Onerep,” and said any other old domains that may be found and associated with his name are no longer being operated by him.

“I get it,” Shelest wrote. “My affiliation with a people search business may look odd from the outside. In truth, if I hadn’t taken that initial path with a deep dive into how people search sites work, Onerep wouldn’t have the best tech and team in the space. Still, I now appreciate that we did not make this more clear in the past and I’m aiming to do better in the future.” The full statement is available here (PDF).

Onerep CEO and founder Dimitri Shelest.

In a statement released today, a spokesperson for Mozilla said it was moving away from Onerep as a service provider in its Monitor Plus product.

“Though customer data was never at risk, the outside financial interests and activities of Onerep’s CEO do not align with our values,” Mozilla wrote. “We’re working now to solidify a transition plan that will provide customers with a seamless experience and will continue to put their interests first.”

KrebsOnSecurity also reported that Shelest’s email address was used circa 2010 by an affiliate of Spamit, a Russian-language organization that paid people to aggressively promote websites hawking male enhancement drugs and generic pharmaceuticals. As noted in the March 14 story, this connection was confirmed by research from multiple graduate students at my alma mater George Mason University.

Shelest denied ever being associated with Spamit. “Between 2010 and 2014, we put up some web pages and optimize them — a widely used SEO practice — and then ran AdSense banners on them,” Shelest said, presumably referring to the dozens of people-search domains KrebsOnSecurity found were connected to his email addresses (dmitrcox@gmail.com and dmitrcox2@gmail.com). “As we progressed and learned more, we saw that a lot of the inquiries coming in were for people.”

Shelest also acknowledged that Onerep pays to run ads on “on a handful of data broker sites in very specific circumstances.”

“Our ad is served once someone has manually completed an opt-out form on their own,” Shelest wrote. “The goal is to let them know that if they were exposed on that site, there may be others, and bring awareness to there being a more automated opt-out option, such as Onerep.”

Reached via Twitter/X, HaveIBeenPwned founder Troy Hunt said he knew Mozilla was considering a partnership with Onerep, but that he was previously unaware of the Onerep CEO’s many conflicts of interest.

“I knew Mozilla had this in the works and we’d casually discussed it when talking about Firefox monitor,” Hunt told KrebsOnSecurity. “The point I made to them was the same as I’ve made to various companies wanting to put data broker removal ads on HIBP: removing your data from legally operating services has minimal impact, and you can’t remove it from the outright illegal ones who are doing the genuine damage.”

Playing both sides — creating and spreading the same digital disease that your medicine is designed to treat — may be highly unethical and wrong. But in the United States it’s not against the law. Nor is collecting and selling data on Americans. Privacy experts say the problem is that data brokers, people-search services like Nuwber and Onerep, and online reputation management firms exist because virtually all U.S. states exempt so-called “public” or “government” records from consumer privacy laws.

Those include voting registries, property filings, marriage certificates, motor vehicle records, criminal records, court documents, death records, professional licenses, and bankruptcy filings. Data brokers also can enrich consumer records with additional information, by adding social media data and known associates.

The March 14 story on Onerep was the second in a series of three investigative reports published here this month that examined the data broker and people-search industries, and highlighted the need for more congressional oversight — if not regulation — on consumer data protection and privacy.

On March 8, KrebsOnSecurity published A Close Up Look at the Consumer Data Broker Radaris, which showed that the co-founders of Radaris operate multiple Russian-language dating services and affiliate programs. It also appears many of their businesses have ties to a California marketing firm that works with a Russian state-run media conglomerate currently sanctioned by the U.S. government.

On March 20, KrebsOnSecurity published The Not-So-True People-Search Network from China, which revealed an elaborate web of phony people-search companies and executives designed to conceal the location of people-search affiliates in China who are earning money promoting U.S. based data brokers that sell personal information on Americans.

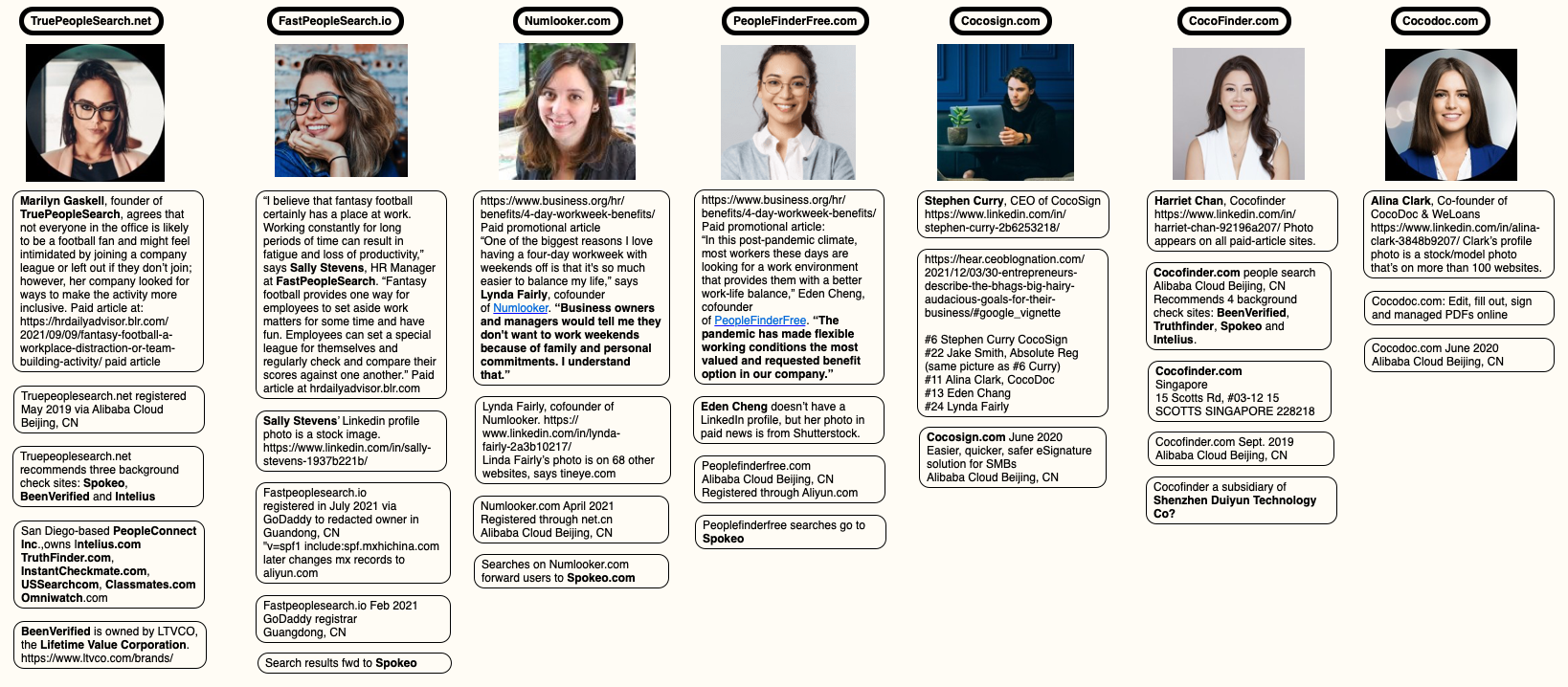

The Not-so-True People-Search Network from China

It’s not unusual for the data brokers behind people-search websites to use pseudonyms in their day-to-day lives (you would, too). Some of these personal data purveyors even try to reinvent their online identities in a bid to hide their conflicts of interest. But it’s not every day you run across a US-focused people-search network based in China whose principal owners all appear to be completely fabricated identities.

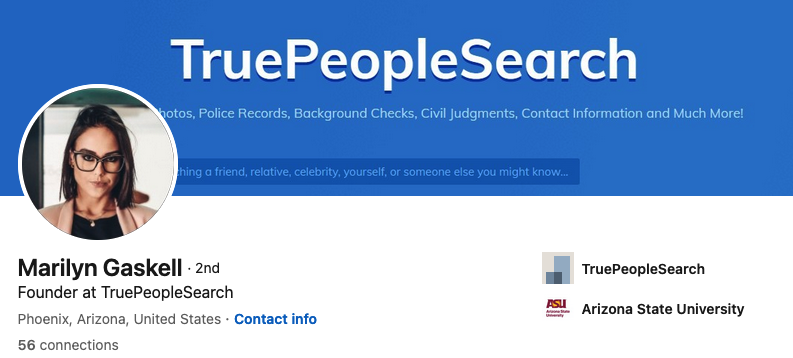

Responding to a reader inquiry concerning the trustworthiness of a site called TruePeopleSearch[.]net, KrebsOnSecurity began poking around. The site offers to sell a report containing photos, police records, background checks, civil judgments, contact information “and much more!” According to LinkedIn and numerous profiles on websites that accept paid article submissions, the founder of TruePeopleSearch is Marilyn Gaskell from Phoenix, Ariz.

The saucy yet studious LinkedIn profile for Marilyn Gaskell.

Ms. Gaskell has been quoted in multiple “articles” about random subjects, such as this article at HRDailyAdvisor about the pros and cons of joining a company-led fantasy football team.

“Marilyn Gaskell, founder of TruePeopleSearch, agrees that not everyone in the office is likely to be a football fan and might feel intimidated by joining a company league or left out if they don’t join; however, her company looked for ways to make the activity more inclusive,” this paid story notes.

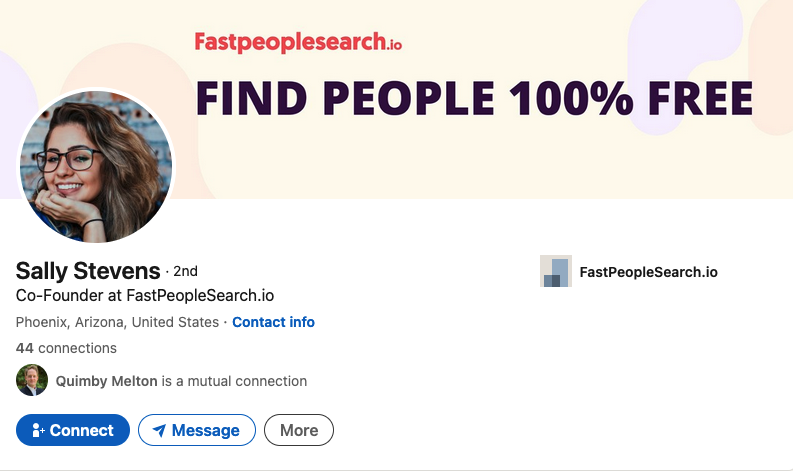

Also quoted in this article is Sally Stevens, who is cited as HR Manager at FastPeopleSearch[.]io.

Sally Stevens, the phantom HR Manager for FastPeopleSearch.

“Fantasy football provides one way for employees to set aside work matters for some time and have fun,” Stevens contributed. “Employees can set a special league for themselves and regularly check and compare their scores against one another.”

Imagine that: Two different people-search companies mentioned in the same story about fantasy football. What are the odds?

Both TruePeopleSearch and FastPeopleSearch allow users to search for reports by first and last name, but proceeding to order a report prompts the visitor to purchase the file from one of several established people-finder services, including BeenVerified, Intelius, and Spokeo.

DomainTools.com shows that both TruePeopleSearch and FastPeopleSearch appeared around 2020 and were registered through Alibaba Cloud, in Beijing, China. No other information is available about these domains in their registration records, although both domains appear to use email servers based in China.

Sally Stevens’ LinkedIn profile photo is identical to a stock image titled “beautiful girl” from Adobe.com. Ms. Stevens is also quoted in a paid blog post at ecogreenequipment.com, as is Alina Clark, co-founder and marketing director of CocoDoc, an online service for editing and managing PDF documents.

The profile photo for Alina Clark is a stock photo appearing on more than 100 websites.

Scouring multiple image search sites reveals Ms. Clark’s profile photo on LinkedIn is another stock image that is currently on more than 100 different websites, including Adobe.com. Cocodoc[.]com was registered in June 2020 via Alibaba Cloud Beijing in China.

The same Alina Clark and photo materialized in a paid article at the website Ceoblognation, which in 2021 included her at #11 in a piece called “30 Entrepreneurs Describe The Big Hairy Audacious Goals (BHAGs) for Their Business.” It’s also worth noting that Ms. Clark is currently listed as a “former Forbes Council member” at the media outlet Forbes.com.

Entrepreneur #6 is Stephen Curry, who is quoted as CEO of CocoSign[.]com, a website that claims to offer an “easier, quicker, safer eSignature solution for small and medium-sized businesses.” Incidentally, the same photo for Stephen Curry #6 is also used in this “article” for #22 Jake Smith, who is named as the owner of a different company.

Stephen Curry, aka Jake Smith, aka no such person.

Mr. Curry’s LinkedIn profile shows a young man seated at a table in front of a laptop, but an online image search shows this is another stock photo. Cocosign[.]com was registered in June 2020 via Alibaba Cloud Beijing. No ownership details are available in the domain registration records.

Listed at #13 in that 30 Entrepreneurs article is Eden Cheng, who is cited as co-founder of PeopleFinderFree[.]com. KrebsOnSecurity could not find a LinkedIn profile for Ms. Chen, but a search on her profile image from that Entrepreneurs article shows the same photo for sale at Shutterstock and other stock photo sites.

DomainTools says PeopleFinderFree was registered through Alibaba Cloud, Beijing. Attempts to purchase reports through PeopleFinderFree produce a notice saying the full report is only available via Spokeo.com.

Lynda Fairly is Entrepreneur #24, and she is quoted as co-founder of Numlooker[.]com, a domain registered in April 2021 through Alibaba in China. Searches for people on Numlooker forward visitors to Spokeo.

The photo next to Ms. Fairly’s quote in Entrepreneurs matches that of a LinkedIn profile for Lynda Fairly. But a search on that photo shows this same portrait has been used by many other identities and names, including a woman from the United Kingdom who’s a cancer survivor and mother of five; a licensed marriage and family therapist in Canada; a software security engineer at Quora; a journalist on Twitter/X; and a marketing expert in Canada.

Cocofinder[.]com is a people-search service that launched in Sept. 2019, through Alibaba in China. Cocofinder lists its market officer as Harriet Chan, but Ms. Chan’s LinkedIn profile is just as sparse on work history as the other people-search owners mentioned already. An image search online shows that outside of LinkedIn, the profile photo for Ms. Chan has only ever appeared in articles at pay-to-play media sites, like this one from outbackteambuilding.com.

Perhaps because Cocodoc and Cocosign both sell software services, they are actually tied to a physical presence in the real world — in Singapore (15 Scotts Rd. #03-12 15, Singapore). But it’s difficult to discern much from this address alone.

Who’s behind all this people-search chicanery? A January 2024 review of various people-search services at the website techjury.com states that Cocofinder is a wholly-owned subsidiary of a Chinese company called Shenzhen Duiyun Technology Co.

“Though it only finds results from the United States, users can choose between four main search methods,” Techjury explains. Those include people search, phone, address and email lookup. This claim is supported by a Reddit post from three years ago, wherein the Reddit user “ProtectionAdvanced” named the same Chinese company.

Is Shenzhen Duiyun Technology Co. responsible for all these phony profiles? How many more fake companies and profiles are connected to this scheme? KrebsOnSecurity found other examples that didn’t appear directly tied to other fake executives listed here, but which nevertheless are registered through Alibaba and seek to drive traffic to Spokeo and other data brokers. For example, there’s the winsome Daniela Sawyer, founder of FindPeopleFast[.]net, whose profile is flogged in paid stories at entrepreneur.org.

Google currently turns up nothing else for in a search for Shenzhen Duiyun Technology Co. Please feel free to sound off in the comments if you have any more information about this entity, such as how to contact it. Or reach out directly at krebsonsecurity @ gmail.com.

A mind map highlighting the key points of research in this story. Click to enlarge. Image: KrebsOnSecurity.com

ANALYSISIt appears the purpose of this network is to conceal the location of people in China who are seeking to generate affiliate commissions when someone visits one of their sites and purchases a people-search report at Spokeo, for example. And it is clear that Spokeo and others have created incentives wherein anyone can effectively white-label their reports, and thereby make money brokering access to peoples’ personal information.

Spokeo’s Wikipedia page says the company was founded in 2006 by four graduates from Stanford University. Spokeo co-founder and current CEO Harrison Tang has not yet responded to requests for comment.

Intelius is owned by San Diego based PeopleConnect Inc., which also owns Classmates.com, USSearch, TruthFinder and Instant Checkmate. PeopleConnect Inc. in turn is owned by H.I.G. Capital, a $60 billion private equity firm. Requests for comment were sent to H.I.G. Capital. This story will be updated if they respond.

BeenVerified is owned by a New York City based holding company called The Lifetime Value Co., a marketing and advertising firm whose brands include PeopleLooker, NeighborWho, Ownerly, PeopleSmart, NumberGuru, and Bumper, a car history site.

Ross Cohen, chief operating officer at The Lifetime Value Co., said it’s likely the network of suspicious people-finder sites was set up by an affiliate. Cohen said Lifetime Value would investigate to determine if this particular affiliate was driving them any sign-ups.

All of the above people-search services operate similarly. When you find the person you’re looking for, you are put through a lengthy (often 10-20 minute) series of splash screens that require you to agree that these reports won’t be used for employment screening or in evaluating new tenant applications. Still more prompts ask if you are okay with seeing “potentially shocking” details about the subject of the report, including arrest histories and photos.

Only at the end of this process does the site disclose that viewing the report in question requires signing up for a monthly subscription, which is typically priced around $35. Exactly how and from where these major people-search websites are getting their consumer data — and customers — will be the subject of further reporting here.

The main reason these various people-search sites require you to affirm that you won’t use their reports for hiring or vetting potential tenants is that selling reports for those purposes would classify these firms as consumer reporting agencies (CRAs) and expose them to regulations under the Fair Credit Reporting Act (FCRA).

These data brokers do not want to be treated as CRAs, and for this reason their people search reports typically don’t include detailed credit histories, financial information, or full Social Security Numbers (Radaris reports include the first six digits of one’s SSN).

But in September 2023, the U.S. Federal Trade Commission found that TruthFinder and Instant Checkmate were trying to have it both ways. The FTC levied a $5.8 million penalty against the companies for allegedly acting as CRAs because they assembled and compiled information on consumers into background reports that were marketed and sold for employment and tenant screening purposes.

The FTC also found TruthFinder and Instant Checkmate deceived users about background report accuracy. The FTC alleges these companies made millions from their monthly subscriptions using push notifications and marketing emails that claimed that the subject of a background report had a criminal or arrest record, when the record was merely a traffic ticket.

The FTC said both companies deceived customers by providing “Remove” and “Flag as Inaccurate” buttons that did not work as advertised. Rather, the “Remove” button removed the disputed information only from the report as displayed to that customer; however, the same item of information remained visible to other customers who searched for the same person.

The FTC also said that when a customer flagged an item in the background report as inaccurate, the companies never took any steps to investigate those claims, to modify the reports, or to flag to other customers that the information had been disputed.

There are a growing number of online reputation management companies that offer to help customers remove their personal information from people-search sites and data broker databases. There are, no doubt, plenty of honest and well-meaning companies operating in this space, but it has been my experience that a great many people involved in that industry have a background in marketing or advertising — not privacy.

Also, some so-called data privacy companies may be wolves in sheep’s clothing. On March 14, KrebsOnSecurity published an abundance of evidence indicating that the CEO and founder of the data privacy company OneRep.com was responsible for launching dozens of people-search services over the years. OneRep still has not responded to that reporting.

Finally, some of the more popular people-search websites are notorious for ignoring requests from consumers seeking to remove their information, regardless of which reputation or removal service you use. Some force you to create an account and provide more information before you can remove your data. Even then, the information you worked hard to remove may simply reappear a few months later.

This aptly describes countless complaints lodged against the data broker and people search giant Radaris. On March 8, KrebsOnSecurity profiled the co-founders of Radaris, two Russian brothers in Massachusetts who also operate multiple Russian-language dating services and affiliate programs.

The truth is that these people-search companies will continue to thrive unless and until Congress begins to realize it’s time for some consumer privacy and data protection laws that are relevant to life in the 21st century. Duke University adjunct professor Justin Sherman says virtually all state privacy laws exempt records that might be considered “public” or “government” documents, including voting registries, property filings, marriage certificates, motor vehicle records, criminal records, court documents, death records, professional licenses, bankruptcy filings, and more.

“Consumer privacy laws in California, Colorado, Connecticut, Delaware, Indiana, Iowa, Montana, Oregon, Tennessee, Texas, Utah, and Virginia all contain highly similar or completely identical carve-outs for ‘publicly available information’ or government records,” Sherman said.